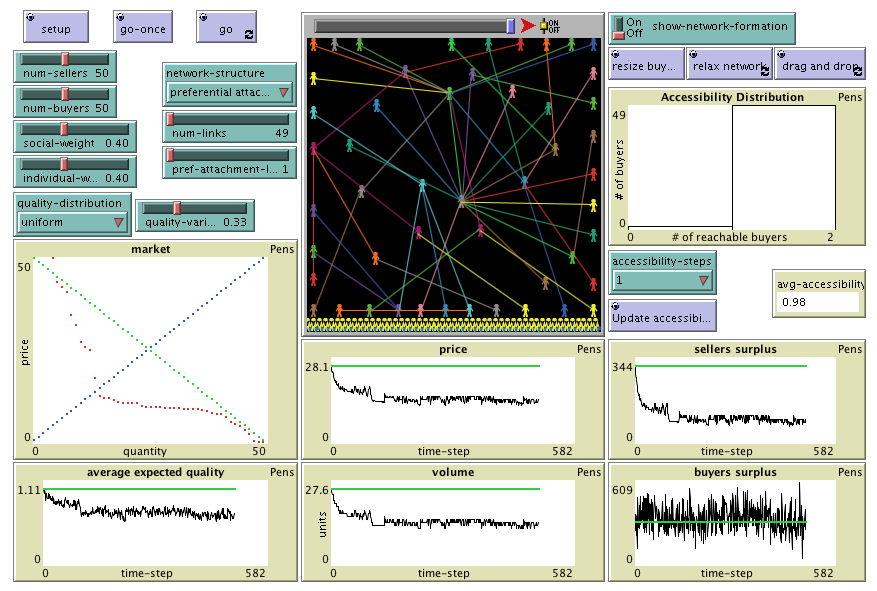

To use MEQU, you will have to install NetLogo 3.0 (free and open source) and download the model itself. Unzip the downloaded file and click on MEQU.nlogo

MEQU (Market Effects of Quality Uncertainty) is a model designed to study the effects of quality uncertainty and incomplete information on market dynamics. The main assumption in this model is that buyers form quality expectations about products based on their own past experiences and on the experiences of people they know.

This model is based on buyers' expected behaviour, in contrast with classical models of quality uncertainty, which, in addition to quality variability, tend to assume asymmetric information and are based on the phenomenon of adverse selection. MEQU shows that asymmetric information is not necessary for quality variability to damage (or even destroy) a market. It also shows how sharing information, or making aggregate information available, can mitigate the damaging effects of quality variability.

Buyers can be connected, forming a social network. Thus, each buyer may link to none, one, or several buyers; this (potentially empty) set of neighbours defines the buyer's social neighbourhood.

If the network-structure is random, then it is created by establishing a certain number (num-links) of directed links between randomly selected pairs of buyers.

If the network-structure is preferential attachment, buyers are sequentially added to the network; every buyer who joins the network selects pref-attachment-links other buyers to link to, who are selected with probability proportional to their number of existing (incoming and outgoing) links. At the beginning of the creation of this network, while the number of buyers is less than pref-attachment-links, each new buyer links to all existing buyers. This is Barabási and Albert's preferential attachment model of network growth (See Newman 2003, sec. VII-B).

If the network-structure is double ring, all buyers are randomly placed in a ring (randomly "seated" at a round table) and each buyer links to the one on her right and to the one on her left.

If the network-structure is star, one buyer is randomly selected and bidirectional links between her and each one of all the other buyers are created.

The supply function is constant. There are num-sellers sellers indexed in i (i = 1,..., num-sellers) with minimum selling price for seller i being mspi = i. A seller i is willing to sell her product if price p >= mspi. This creates a supply function such that the number of items offered at price p (p >= 0) is the integer part of p (with the additional restriction that the number of items offered must always be less than, or equal to, num-sellers).

The demand function in every session is formed by summing up buyers' individual reservation prices. The reservation price of buyer i in session n is equal to her initial reservation price multiplied by her current expected quality (qexpi,n) for the product.

At any trading session n, the num-buyers individual reservation prices can be sorted out as follows:

R1,n >= R2,n >= … >= Rnum-buyers,n

This order will be useful to determine the price (see below). Finally, note that, given the description above, the initial demand is such that at price p (p ≤ num-buyers), the number of products demanded is the integer part of [num-buyers + 1 - p] (with the additional restriction that it always must be less than, or equal to, num-buyers).

Buyers and sellers trade in sessions. In each session, each buyer can buy at most one product, and each seller can sell at most one product. In each session n, the market is centrally cleared at the crossing point of supply and demand. Specifically, the number of traded units y in session n is the maximum value i such that Ri,n >= mspi and the market price pn is taken to be

pn = [Min (Ry,n, mspy+1) + Max (Ry+1,n, mspy)] / 2

This price-setting formula takes into account the satisfied supply and demand ( mspy ≤ pn ≤ Ry,n ) and the pressure of the extramarginal supply and demand ( mspy+1 >= pn >= Ry+1,n ).

In general, buyers form their quality expectations considering both their own experience and their social neighbours' experience. More precisely, after every trading session, every buyer i updates her quality expectation if and only if

In either of those cases, buyer i updates her expectations according to the following rules:

qexpi,n+1 = qexpi,n + individual-weight · (qi,n - qexpi,n) + social-weight · (meanqi,n - qexpi,n)

where qi,n is the quality of the product received by buyer i, and meanqi,n is the average quality of the products received by buyers in i's social neighbourhood.qexpi,n+1 = qexpi,n + individual-weight · (qi,n - qexpi,n)

qexpi,n+1 = qexpi,n + social-weight · (meanqi,n - qexpi,n)

There are a number of ways in which the user can interact with the model. Except for the number of sellers and buyers, the value of every parameter described above can be changed at runtime. Thus, except for potentially those two parameters, the model is always using the values that are shown in the interface. Note that, in particular, the user can create and delete random links in the network as the model runs. This can be conducted by modifying the number of links directly. All links are created or deleted at random. There are also other ways, all of them related to the social network, in which the user can interact with the model at runtime:

Create a market without social network (num-links = 0). Use some quality variability and individual-weight which are not very low and observe the market failure.

Select a social-weight greater than 0, increase the number of links in the network and observe the recovered dynamics. The market failure is also visible if there is a social network but the social-weight is set to 0.

MEQU is a model designed to study the effects of quality uncertainty and incomplete information on market dynamics.

Copyright (C) 2005 Segismundo S. Izquierdo & Luis R. Izquierdo

This program is free software; you can redistribute it and/or modify it under the terms of the GNU General Public License as published by the Free Software Foundation; either version 3 of the License, or (at your option) any later version.

This program is distributed in the hope that it will be useful, but WITHOUT ANY WARRANTY; without even the implied warranty of MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the GNU General Public License for more details.

You can download a copy of the GNU General Public License by clicking here; you can also get a printed copy writing to the Free Software Foundation, Inc., 51 Franklin Street, Fifth Floor, Boston, MA 02110-1301, USA.

Contact information:

Luis R. Izquierdo

University of Burgos, Spain.

e-mail: lrizquierdo@ubu.es

MEQU was developed by Segismundo S. Izquierdo & Luis R. Izquierdo. The authors would like to gratefully acknowledge financial support from the Scottish Executive Environment and Rural Affairs Department and from the SocSimNet project 2004-LV/04/B/F/PP.

Akerlof GA (1970). The Market for Lemons: Quality Uncertainty and the Market Mechanism. The Quarterly Journal of Economics 84: 488-500

Hendel I and Lizzeri A (1999). Adverse selection in Durable Goods Markets. American Economic Review 89 (5): 1097-1115

Izquierdo SS, Izquierdo LR (2006). The Impact of Quality Uncertainty without Asymmetric Information. Agent Based Models of Market Dynamics and Consumer Behaviour, Pre-proceedings.

Izquierdo SS, Izquierdo LR, Galan JM and Hernandez C (2005). Market Failure caused by Quality Uncertainty. Artificial Economics - Lecture Notes in Economics and Mathematical Systems 564. Springer-Verlag, Berlin, 2005.

Macho-Stadler I and Pérez-Castrillo JD (2001). An Introduction to the Economics of Information. Incentives and Contracts. Oxford University Press (Second edition)

Newman M.E.J. (2003). The structure and function of complex networks. SIAM Review 45, 167-256 .

Rose C (1993). Equilibrium and Adverse Selection. The RAND Journal of Economics, 24 (4): 559-569

Stigler GJ (1961). The Economics of Information. Journal of Political Economy 69: 213-225

Stiglitz JE (2000) The Contributions of the Economics of Information to Twentieth Century Economics. The Quarterly Journal of Economics, Vol. 115, Issue 4 - pp. 1441 - 1478

Vriend N (2000). An Illustration of the Essential Difference Between Individual and Social Learning, and its Consequence for Computational Analyses. Journal of Economic Dynamics and Control 24: 1-19

Wilensky U (1999) NetLogo. Center for Connected Learning and Computer-Based Modeling, Northwestern University, Evanston, IL.

Wilson CA (1979). Equilibrium and adverse selection. American Economic Review 69: 313-317

Wilson CA (1980). The Nature of Equilibrium in Markets with Adverse Selection. Bell Journal of Economics 11: 108-130